IN Form NO 15G free printable template

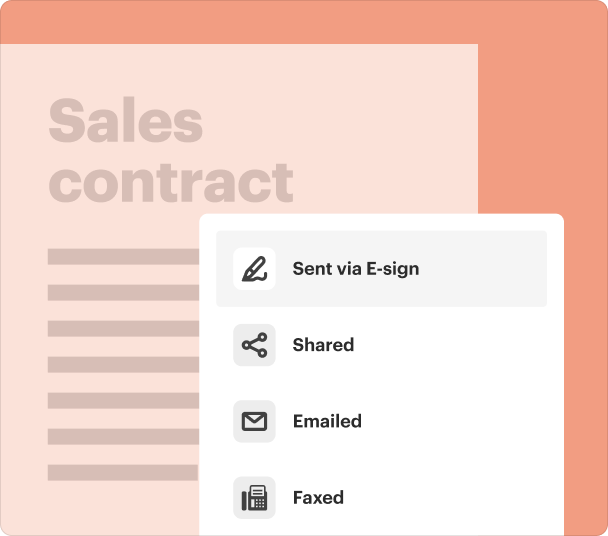

Fill out, sign, and share forms from a single PDF platform

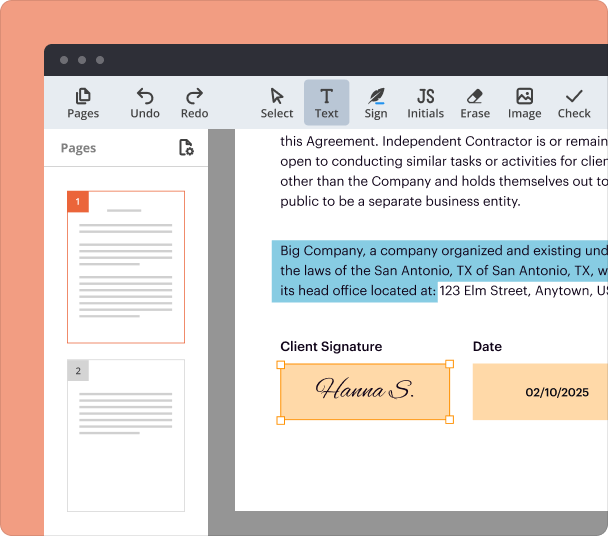

Edit and sign in one place

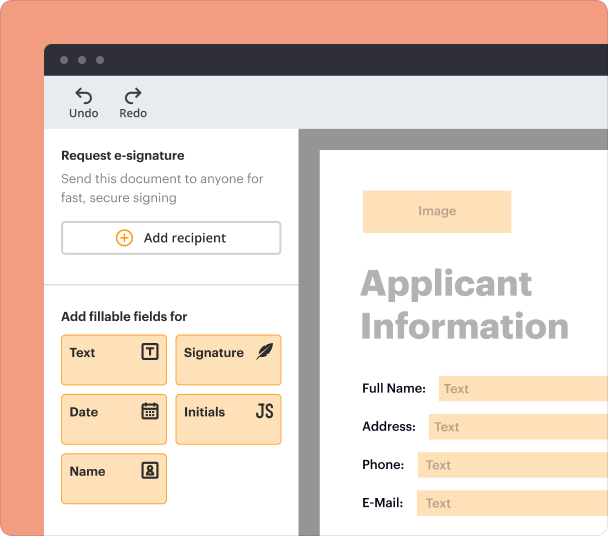

Create professional forms

Simplify data collection

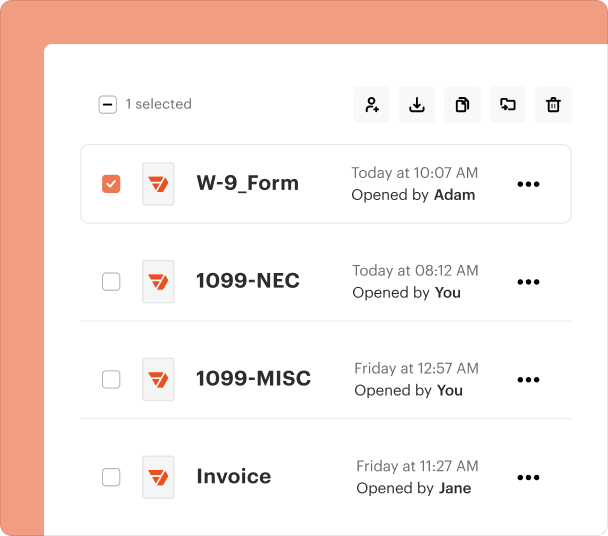

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

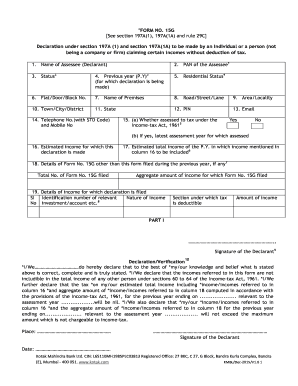

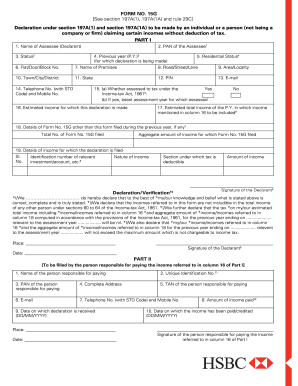

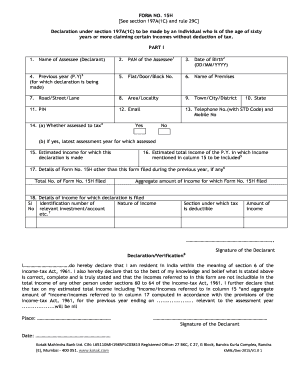

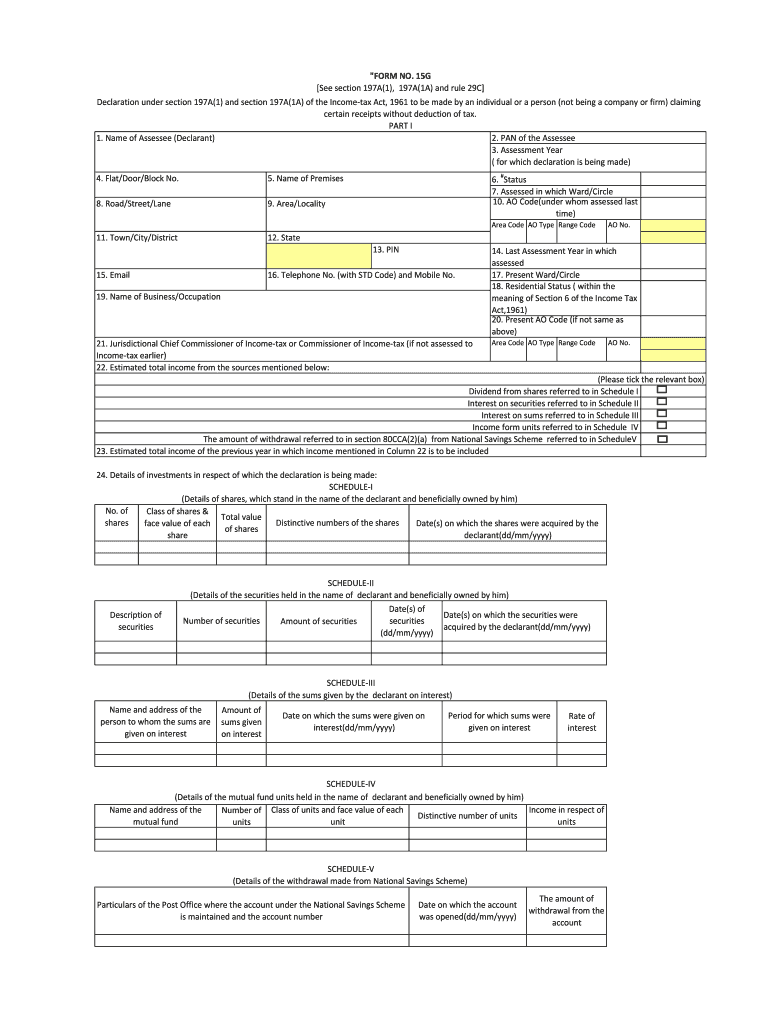

Understanding Form No 15G

What is Form No 15G?

Form No 15G is a declaration made by an individual or a non-corporate entity claiming certain receipts without the deduction of tax. It is essential for taxpayers in the United States who wish to avoid tax deduction on specific income, such as interest on savings accounts or fixed deposits, as long as their total annual income is below the taxable limit.

Key Features of Form No 15G

This form allows individuals to declare their income status to banks or financial institutions, thus facilitating tax exemption on interest income. Key features include:

-

Tax exemption eligibility for total income below the taxable threshold.

-

Simplified process for income declaration and tax management.

-

Used primarily for interest earnings from banks or investments.

When to Use Form No 15G

Form No 15G should be utilized by individuals seeking to avoid tax deductions on income when their total income is below the prescribed limit. It is particularly pertinent when receiving amounts like interest on fixed deposits or savings accounts, as it helps retain full earnings without tax deductions.

Eligibility Criteria for Form No 15G

To qualify for submitting Form No 15G, individuals must meet certain criteria, including:

-

Total taxable income below the exemption limit for the relevant assessment year.

-

Must be a resident individual or a non-corporate taxpayer.

-

Income sources should primarily include interest earnings.

How to Fill Form No 15G

Filling out Form No 15G requires accurate personal and financial information. The following steps guide users through the completion process:

-

Provide the Permanent Account Number (PAN) and personal details.

-

Declare the estimated total income for the financial year.

-

Specify the nature and source of income receiving exemption.

-

Sign and submit the form to the relevant financial institution.

Common Errors to Avoid

While completing Form No 15G, users may encounter common mistakes that could invalidate their submissions. Key errors to avoid include:

-

Entering an incorrect PAN or personal details.

-

Misestimating the total income for the year.

-

Failing to sign the form before submission.

Frequently Asked Questions about form 15g download

What should I do if my income exceeds the exemption limit?

If your income exceeds the exemption limit, you will not be able to use Form No 15G to avoid tax deductions. Instead, you might need to ensure proper tax payments based on your income level.

Can Form No 15G be submitted multiple times for different income sources?

Yes, individuals can submit Form No 15G for multiple income sources, provided each source meets the eligibility criteria and the total income remains below the taxable threshold.

pdfFiller scores top ratings on review platforms