IN Form NO 15G free printable template

Show details

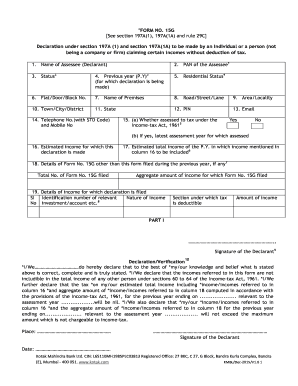

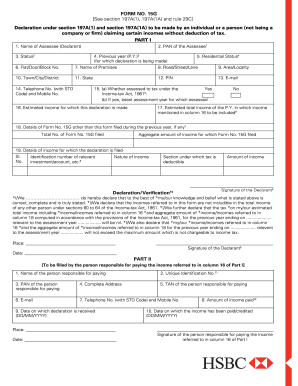

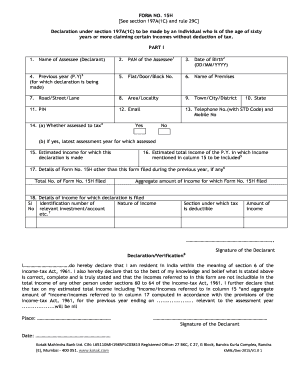

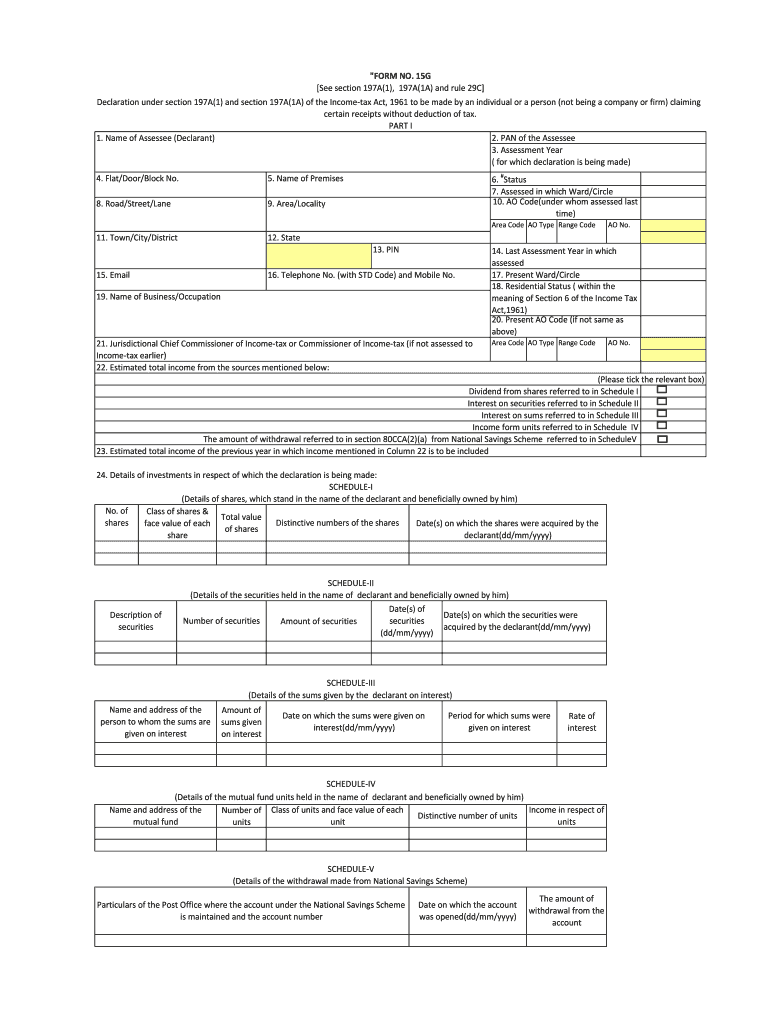

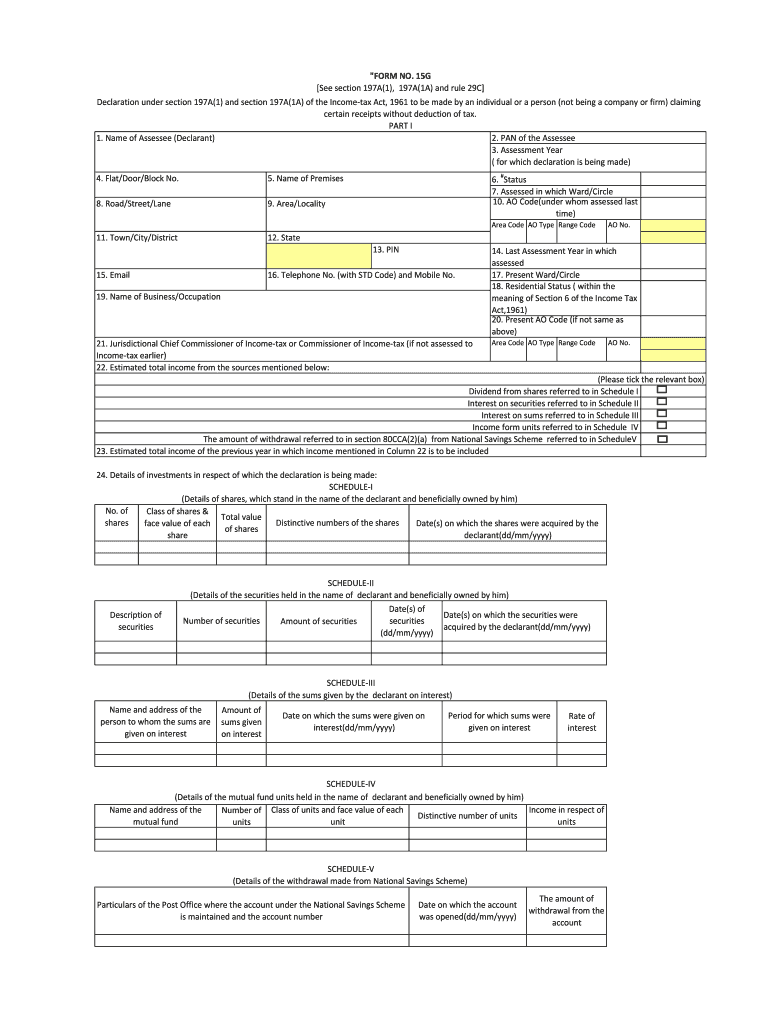

“FORM NO. 15G See section 197A(1), 197A(1A) and rule 29C Declaration under section 197A(1) and section 197A(1A) of the Income tax Act, 1961 to be made by an individual or a person (not being a company

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 15g download

Edit your download form 15g form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 15g for pf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 15 g pf withdrawal pdf online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 15 g. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 15 g epfo

How to fill out IN Form NO. 15G

01

Obtain the IN Form NO. 15G from the appropriate tax authority or download it from their website.

02

Enter your name as it appears on your PAN card in the designated field.

03

Provide your PAN (Permanent Account Number) in the specified area.

04

Fill in your address, ensuring it is complete and accurate.

05

Mention the financial year for which you are submitting the form.

06

Provide the relevant details about the income that is exempt from tax.

07

Sign and date the form at the bottom to certify the information provided.

Who needs IN Form NO. 15G?

01

Individuals who have income that is not taxable under the Income Tax Act.

02

Persons earning interest from fixed deposits or savings accounts that are below the taxable limit.

03

People seeking to ensure that tax is not deducted at source on eligible income.

Fill

15g form epfo

: Try Risk Free

What is fillable 15g form?

For age below 60 year - If your interest income on bank / post office deposits exceeds Rs 10000 a year, the bank will deduct 10% tax at source. ... However, you can submit a Form 15G to avoid TDS on interest income.

People Also Ask about pf form 15g download pdf

Can I fill up 15G form online?

EPFO portal has launched online submission of form 15G while submitting EPF withdrawal claim online. However, you can also fill and submit a physical copy to EPFO regional office for non-deduction of TDS.

How can I get form 15G from EPF portal?

# Login to EPFO UAN Unified Portal for members. # Click on ONLINE SERVICES >> Claim (Form 31, 19, 10C). # Then you will see the EPF withdrawal form. # Below I want to apply for, you will see Upload Form 15G as shown in the below image.

Is 15G compulsory for PF withdrawal?

If you are early withdrawing your PF amount before the completion of five years, then it becomes necessary for you to fill the Form 15G to avoid tax deduction. However, if PF withdrawal happens after five years, then there is no requirement of Form 15G as the withdrawal would be tax free.

How can I download form 15G?

Here's how you can do it: Log into your bank's internet banking with applicable User ID and Password. Click on the online fixed deposits tab which will take you to the page where your fixed deposit details are displayed. On the same page, you should have the option to generate Form 15G and Form 15H.

Should I submit 15G or 15H?

Select 15G if you are below 60 years and 15H if above 60 years.

What is the difference between form 15G and 15H?

What is the difference between Form 15G and Form 15H? Both are self-declaration forms that you have to submit to the bank once you open a fixed deposit. While Form 15G is for those who are below 60 years and come under Hindu Undivided Families (HUF), Form 15H is for everyone who is 60 years and above.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my epfo 15g form in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your fill form 15g online along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I complete form 15g pf online?

pdfFiller has made it simple to fill out and eSign 15 g form. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I fill out the pf form 15g download form on my smartphone?

Use the pdfFiller mobile app to fill out and sign 15g form for pf. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is IN Form NO. 15G?

IN Form NO. 15G is a self-declaration form used in India for individuals to ensure that no tax is deducted at source on income received, provided their total taxable income is below the threshold limit.

Who is required to file IN Form NO. 15G?

Individuals with a total taxable income below the taxable limit are required to file IN Form NO. 15G to prevent tax deduction at source on their interest income or similar earnings.

How to fill out IN Form NO. 15G?

To fill out IN Form NO. 15G, provide details such as your name, address, PAN (Permanent Account Number), the financial institution's name, the amount of income, and your signature, ensuring all provided details are accurate.

What is the purpose of IN Form NO. 15G?

The purpose of IN Form NO. 15G is to allow individuals to declare that their total income is below the taxable limit, thus preventing the deduction of tax at source on certain income types.

What information must be reported on IN Form NO. 15G?

The information that must be reported on IN Form NO. 15G includes the individual's name, address, PAN, the amount of interest income, and the details of the financial institution paying the income.

Fill out your IN Form NO 15G online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Can I Fill Up 15g For Non Deduction Of Tds is not the form you're looking for?Search for another form here.

Keywords relevant to form 15g for pf withdrawal download pdf

Related to form 15g fill online

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.